Sbi Recurring Deposit Interest Rates 2020

SBI FD Online – State Bank of India is India’s largest public sector bank. SBI FD is one of the most preferred, popular, and safe investment options. SBI FD’s are offered with an interest rate of 2.9% to 6.2%. SBI fixed deposit can be purchased offline as well as online. You just required a net banking facility to open SBI fixed deposit online. You can also renew or close fixed deposit online.

SBI Fixed deposit key features

- SBI Fixed deposit interest rate payment is monthly, quarterly, or maturity basis as per your requirement.

- The rate of interest applicable is different based on duration and amount of FD.

- A higher interest rate applies to the senior citizen.

- Deposit tenure is 7 days to 10 years.

- The minimum deposit amount is Rs.1000. No limit on the maximum amount.

- The nomination facility is available on the fixed deposit.

- Premature withdrawal can be done by paying a penalty.

- TDS is applicable if form 15G or 15H is not submitted.

- Automatic renewal is done in case instruction for closure is not given.

STATE BANK OF INDIA RD calculator online - Calculate STATE BANK OF INDIA RD Interest rate using STATE BANK OF INDIA Recurring Deposit calculator 2021. Check STATE BANK OF INDIA RD rate of interest and calculate RD final amount via STATE BANK OF INDIA RD Calculator on The Economic Times. Note - The interest rates have been revised w.e.f. From 10 September 2020. When you withdraw money from the MODS account, you will continue to earn the term deposit rates applicable at the time of initial deposit on your balance amount. Country's top lender, State Bank of India (SBI), has cut interest rates on recurring deposits (RDs) from 10th January. SBI RD has terms ranging from 1 year to 10 years.

SBI FD Options

SBI Term Deposit

SBI Term Deposit is also known as normal fixed deposit. This type of deposit is opened for a specific term. Term deposit offers guaranteed returns, choice of interest payout & liquidity. The tenure of this deposit is from 7 days to 10 days. Interest payout is monthly, quarterly, half-yearly and yearly.

Do not miss below posts -

SBI Tax Saving FD

The fixed deposit that is used for saving tax is known as Tax Saving FD. The rate of interest applicable to SBI Tax Saving FD is same as that of term deposit. The lock-in period for tax saving FD is 5 years. The amount is payable only at the time of maturity.

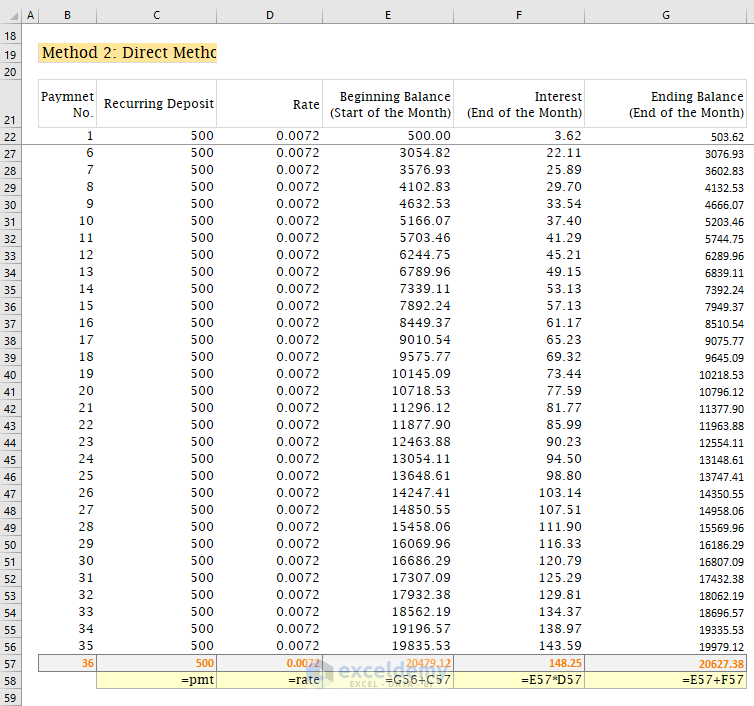

SBI Recurring Deposit

A recurring deposit is one that allows investor to invest fixed sum over a period of time. The minimum period is 12 months and the maximum period is 120 months. The minimum deposit amount is Rs.100 per month.

SBI FD reinvestment scheme

SBI FD reinvestment scheme is a scheme where interest earned is reinvested in the fixed deposit again to generate appreciation. The maturity duration is 6 months to 10 years. If you are not in need of money for long term you can opt for a reinvestment scheme.

Who can open SBI FD?

The eligibility criteria to open SBI FD is given below.

Sbi Term Deposit Interest Rates June 2020

- The depositor must be an Indian resident

- NRI are also eligible to open NRE fixed deposit

- Partnership firm and HUF

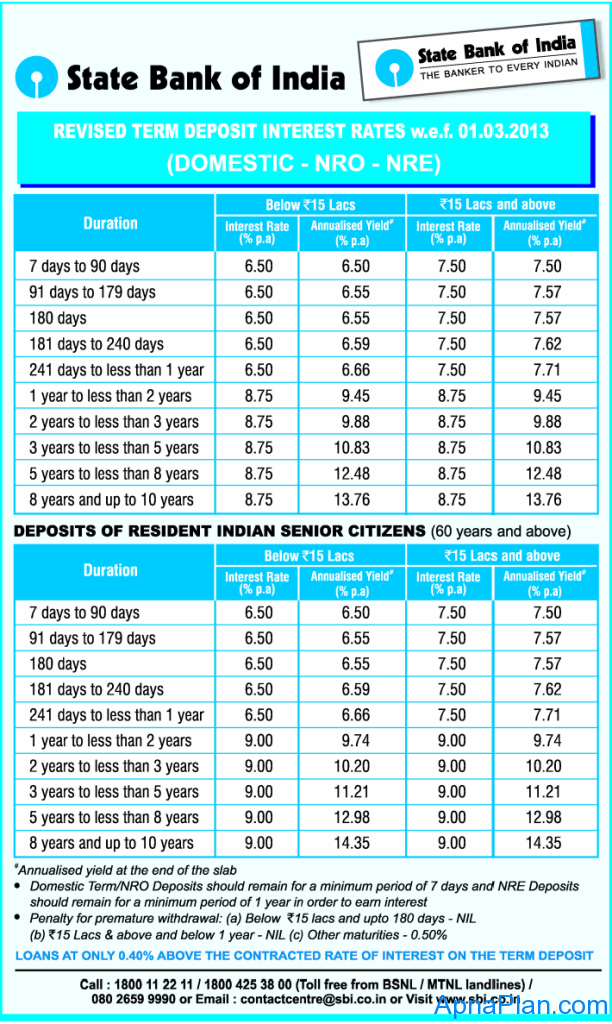

SBI FD Interest Rates 2021

Domestic term deposit interest rate below 2 Cr.

| Tenors | Revised Rates For Public w.e.f. 08.01.2021 | Revised Rates for Senior Citizens w.e.f. 08.01.2021 |

| 7 days to 45 days | 2.90% | 3.40% |

| 46 days to 179 days | 3.90% | 4.40% |

| 180 days to 210 days | 4.40% | 4.90% |

| 211 days to less than 1 year | 4.40% | 4.90% |

| 1 year to less than 2 year | 5.00% | 5.50% |

| 2 years to less than 3 years | 5.10% | 5.60% |

| 3 years to less than 5 years | 5.30% | 5.80% |

| 5 years and up to 10 years | 5.40% | 6.20% |

Sbi Term Deposit Interest Rates 2020

How to open SBI FD Online?

Step by step method to open SBI FD online is given below.

Sbi Recurring Deposit Interest Rates

- Visit SBI net banking website and login via net banking user name and password.

- Under fixed deposit section you will find e-TDR/e-STDR (FD). Click on that option to proceed. TDR stands for term deposit and STDR stands for Special Term Deposit.

- Select the appropriate option and click on Proceed. You will be able to see multiple bank accounts that you have with SBI.

- You need to select the account from which the money needs to be debited.

- Now enter the fixed deposit principal amount in the amount column.

- Select the tenure of the deposit. You have options to select days, years, months, days or maturity date.

- Now choose the maturity instruction on your tem deposit. Click on the terms and condition and press submit button.

- Your Fixed deposit will be generated with complete details such as name, tenure, principal amount, maturity amount. You need to press OK button.

- You can note down the transaction number for the future reference. The on screen PDF can be downloaded.

You will need documents such as identity proof – Aadhaar card, Passport, PAN card, passport size photos. Bank will also ask for resident proof, age proof and income proof for opening for fixed deposit.